When Charles Dow invented swing trading in the late 1908, he could not imagine such a great diffusion of this simple global yet very effective technique.

What he used to say: “Operate on active markets with many operations and count on stop loss protection” still sounds like pure wisdom today.

The Forex market is certainly an ideal market for this trading technique considering the possibility of going long or short at any time and with any currency asset.

But what is swing trading really about? The aim of this trading technique is to look for the best probability to realize a certain operation, a chance to know the future direction of a currency exchange over a period of time.

Any chance of success is not worth anything if it is not matched with an effective money management policy; the loss of the capital in a few trades is a high risk in forex where the use of a particularly high leverage is quite common. Thanks to swing trading, the trader is able to take advantage of the chances to get a profit by fixing the appropriate stop loss levels right away.

Swing Trading Technique

As with so many other techniques, swing trading has the highest probability of success when used to open a trade in the direction of the main trend; usually the tests of the last low and top as entry level are the landmarks. After evaluating the price reaction on these resistances / supports, the trader can create a hopefully winning strategy.

Some examples just to clarify the concept.

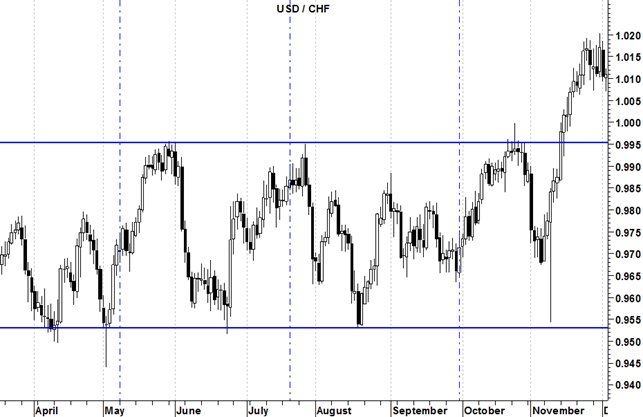

UsdChf alternated a classic trading range during the April-November 2016 period. Tops and lows have alternated with fairly similar price behaviours close to primary resistances and supports.

In three occasions on the low of area 0.95, three price actions based on the hammer figure allowed UsdChf to regain the top of the range. When these figures are close to a primary support, the value of the price pattern is much higher.

The swing trading technique can be based on analysis and subsequent trade applications based on static but also dynamic supports / resistances. The difference is simple. While static resistances and supports are predefined values from past price behaviour, dynamic supports and resistances change their values; the classic example is a moving average.

Obviously, the moving average must be significant and this feature is acquired after at least two price contact tests that will allow to acquire the indicator as a primary resistance or support. Here is a sample chart to better clarify this issue.

The EurGbp chart summarizes this concept and above all shows the simplicity of applying the swing trading technique. As we can see, static resistances (blue line) are reinforced by dynamic resistances (moving average red line). In technical analysis however, the best setups can be found when price signals are confirmed by oscillators. Thus, the presence of an overbought oscillator that confirms the price fall after a resistance test contributes to strengthening the signal power.