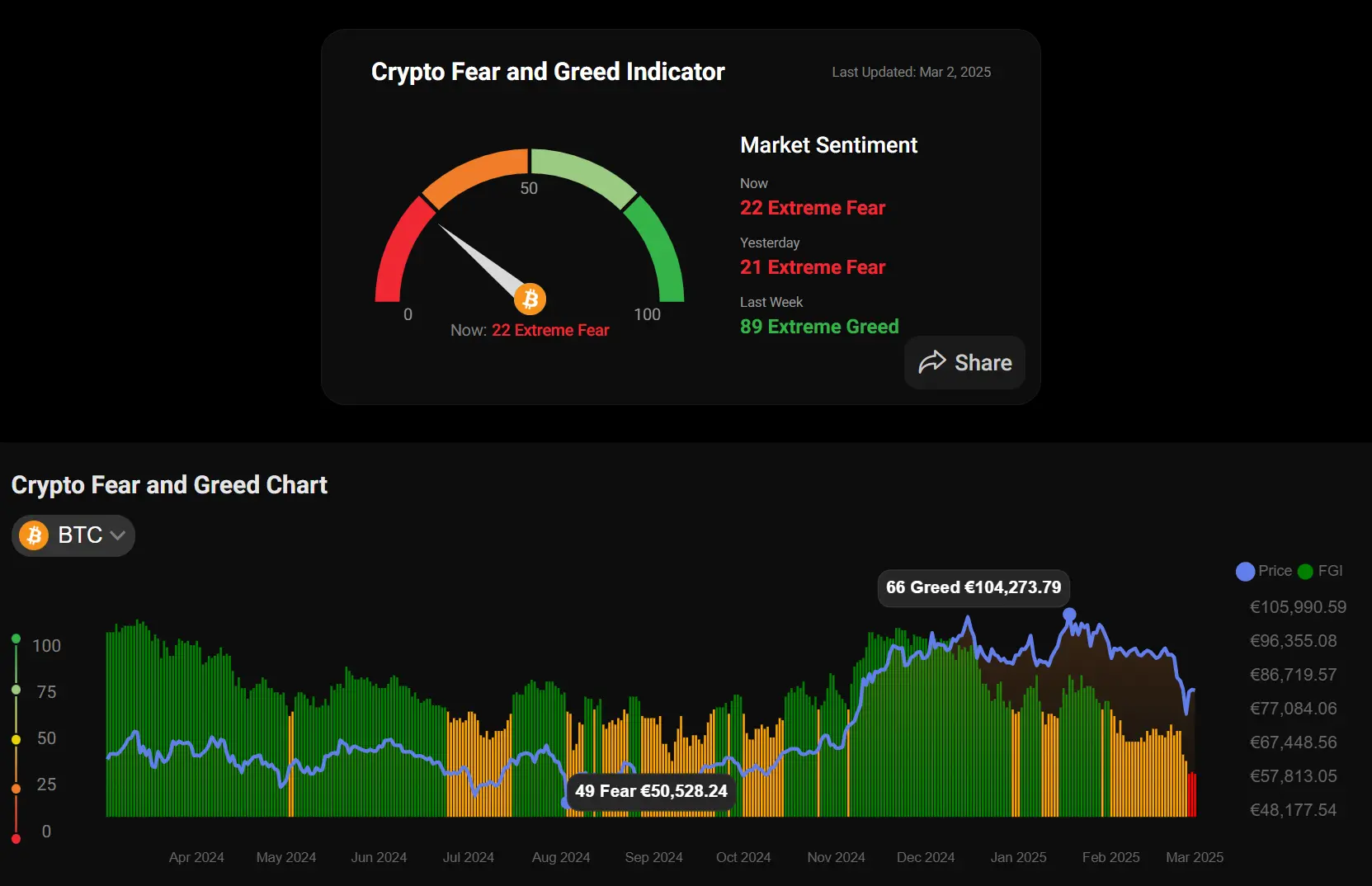

The Bitcoin Fear & Greed Index has plunged into the Extreme Fear zone, signaling heightened uncertainty in the crypto market. Historically, such moments have often marked market bottoms – but is this time different?

What Is the Bitcoin Fear & Greed Index?

The Fear & Greed Index is one of the most widely followed market sentiment indicators, measuring emotions in the cryptocurrency market on a scale from 0 to 100:

- 0-25: Extreme Fear – Investors are deeply pessimistic, potentially signaling buying opportunities.

- 26-50: Fear – Cautious sentiment, often after price corrections.

- 51-75: Greed – Optimism dominates, but markets may be overheated.

- 76-100: Extreme Greed – Euphoria sets in, often preceding market corrections.

At the moment, the index sits at 22, firmly in Extreme Fear territory.

Market Analysis: What’s Behind the Drop?

A few weeks ago, when Bitcoin was trading above €100,000, the index reflected Greed. However, a sharp sentiment shift in the past week has pushed the index into Extreme Fear, with Bitcoin now trading around €75,000.

A similar situation occurred in August 2024, when the index hit 49 (Fear), and Bitcoin was priced at €50,500. Shortly after, the market staged a strong recovery, reinforcing the idea that fear-driven market dips often present buying opportunities.

Buying Opportunity or More Pain Ahead?

Historically, Extreme Fear has preceded strong market rebounds, especially for long-term investors. However, this does not guarantee an immediate bottom, as fear-driven sell-offs can extend further.

Risk of Further Declines – Market sentiment can remain fearful for weeks or months before stabilizing.

Dollar-Cost Averaging (DCA) – A disciplined approach to buying Bitcoin over time can help investors mitigate risk while taking advantage of lower prices.

Market Uncertainty Remains High – Factors like Trump’s presidency, trade wars, and geopolitical tensions (e.g., Ukraine) add to unpredictability.

Key takeaway: While timing the exact bottom is difficult, history suggests that buying during periods of Extreme Fear has often resulted in strong returns over time.

Final Thoughts: Think Long-Term, Manage Risk

The crypto market is inherently volatile, and price swings can be dramatic. Investors should carefully assess their risk tolerance and investment horizon before making decisions.

✔️ Avoid emotional trading – Reacting impulsively to fear or greed can lead to poor decisions.

✔️ Consider risk management – Invest only what you can afford to lose.

✔️ Stay informed – Keeping track of macroeconomic trends and regulatory developments is crucial.

While uncertainty remains, one thing is clear: market sentiment can shift quickly. Those who stay rational and disciplined during moments of fear often emerge as the biggest winners.