Ark Invest, the innovation-focused investment firm led by Cathie Wood, has significantly raised its long-term price projections for Bitcoin, suggesting the cryptocurrency could reach up to $2.4 million by the end of the decade in its most optimistic scenario.

This bold update comes as part of Ark’s latest commentary on its annual research report, “Big Ideas 2025”, which explores disruptive technologies and their investment implications. While Ark had already outlined ambitious price targets for Bitcoin earlier this year, the revised forecast marks a substantial upward revision across all scenarios.

Three Updated Scenarios for Bitcoin’s Future

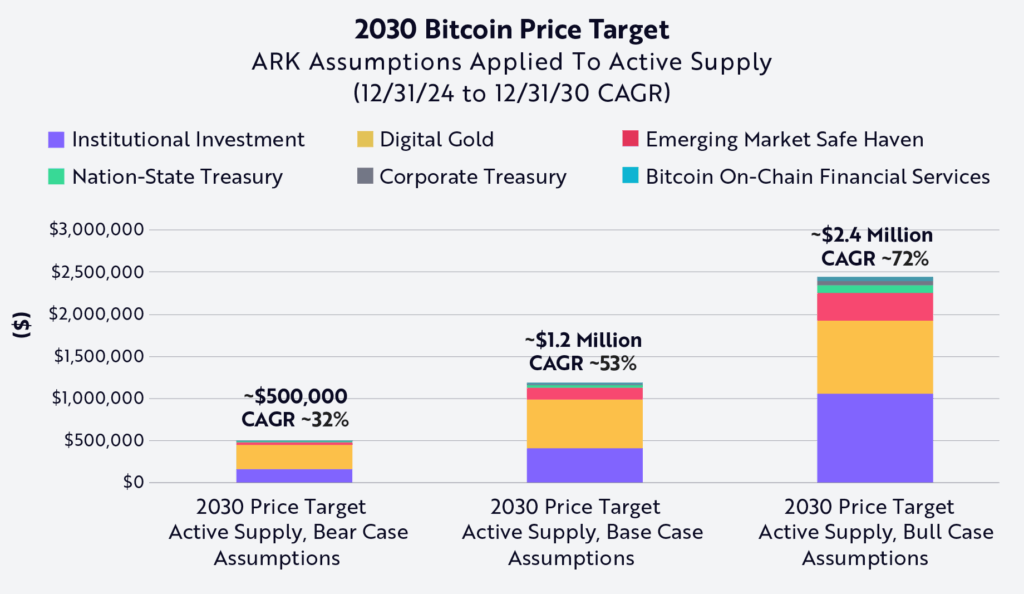

Ark now projects the following potential outcomes for Bitcoin by 2030:

-

Bear Case: $500,000 (previously $300,000)

-

Base Case: $1.2 million (previously $710,000)

-

Bull Case: $2.4 million (previously $1.5 million)

The most optimistic target would represent a 25x increase from Bitcoin’s current price of around $94,000, as of April 2025.

Why the Revision? New Models Focus on Liquidity and Scarcity

According to David Puell, a prominent on-chain analyst at Ark, these updated projections are based on a new experimental valuation model that emphasizes Bitcoin’s active supply — that is, the portion of Bitcoin that is actually available for trading and not held in dormant or lost wallets.

Ark’s research suggests that only around 60% of Bitcoin’s total circulating supply is truly liquid. The rest is either:

-

Held tightly by long-term holders who rarely sell, or

-

Permanently lost due to forgotten or inaccessible private keys.

By applying traditional valuation models (such as stock-to-flow and Metcalfe’s Law) to this smaller liquid supply, rather than the full 21 million BTC limit, Ark believes the price of each actively traded Bitcoin would have to rise substantially to absorb institutional demand and macroeconomic shifts.

Adoption Remains the Key Catalyst

Ark’s projections are not purely theoretical. Each scenario is built on realistic assumptions about growing institutional adoption, including:

-

Corporations adopting Bitcoin as a strategic treasury asset, replacing part of their cash reserves with BTC.

-

Sovereign wealth funds and developing nations adding Bitcoin to their foreign currency reserves, as El Salvador and, more recently, the US started to explore.

-

Growth of Bitcoin-native financial services, such as lending, stablecoins, and smart contract platforms built on Bitcoin’s Layer 2 networks (e.g., Lightning and RSK).

-

Bitcoin’s increasing appeal as “digital gold” in a world of mounting inflation, currency devaluation, and geopolitical instability — particularly for emerging markets where capital flight and inflation are constant threats.

Ark Invest’s History of Bold Predictions

Cathie Wood and her team are known for their visionary (and sometimes controversial) forecasts, but they have also been early believers in technologies that later gained mainstream adoption — from Tesla to gene editing to artificial intelligence. Ark’s bullish stance on Bitcoin has remained consistent since 2015, and the firm has been among the most vocal advocates for Bitcoin ETFs and blockchain innovation.

Their strong convictions are now bolstered by the successful launch of spot Bitcoin ETFs in the U.S., growing mainstream financial integration, and a favorable shift in regulatory tone under the current U.S. administration, which has declared an intention to make the country a global leader in digital assets.

Investor Takeaway

While a $2.4 million Bitcoin by 2030 may sound ambitious — even extreme — Ark Invest’s underlying thesis rests on credible macroeconomic trends: declining trust in fiat currencies, increasing institutional demand, and Bitcoin’s inherent scarcity.

For long-term investors who see Bitcoin not just as a speculative asset but as a monetary revolution, these projections offer food for thought — and potentially, a strategic framework for portfolio allocation.

As always, such targets come with significant volatility and risk, but for those who believe in Bitcoin’s future, Ark’s research offers a high-conviction roadmap to watch closely.

Read more about buying bitcoin.