The financial system as we know it today is a legacy of the broken Bretton Woods deal. When the Americans didn’t want/couldn’t keep the dollar pegged to gold, the dollar became the central piece or the pillar of it.

Sovereign states choose to keep their reserves in various assets. The local currency is one thing, but national central banks know better than anyone that diversification protects against headwinds.

For this reason, they keep part of the reserves in gold, in SDR (Special Drawing Rights) at the IMF (International Monetary Fund), but also in other currencies. As the U.S. Dollar belongs to the strongest economy in the world, it is a natural choice.

Moreover, commodities are valued in American dollars (e.g., oil) so every nation deals, one way or the other, with the U.S. Dollar. It shouldn’t come as a surprise that the dollar is the favorite choice when sovereign states build foreign reserves. For this reason, the dollar is the world’s reserve currency.

The United States of America enjoys an enormous benefit as it can finance its deficit via the constant demand for dollars from foreign nations. For example, by acquiring U.S. Treasuries.

It makes the dollar the center piece of the global financial world. And, the cornerstone in Forex trading.

Majors, Crosses, and the U.S. Dollar

Traders buy and sell a currency or a currency pair due to a set of reasons. Technical traders only look at charts and at various trading analysis and theories and buy and sell a currency pair.

Having a firm belief that technical analysis prevails, they don’t care much about the economic reality. In a way, it is normal, because not all traders have an economic background.

In fact, probably very few, and this is a reasonable explanation why technical analysis has such success to the retail trader. But like it or not, Forex trading is mostly about interpreting the data, positioning before and after economic releases, and, above all, interpreting the two economies part of a currency pair.

While technical analysis may give the direction of a trade, the forex fundamental analysis offers the reason. And, while sometimes the technical side of a trade might be wrong but has a quick fix, the fundamental reason doesn’t change that easy.

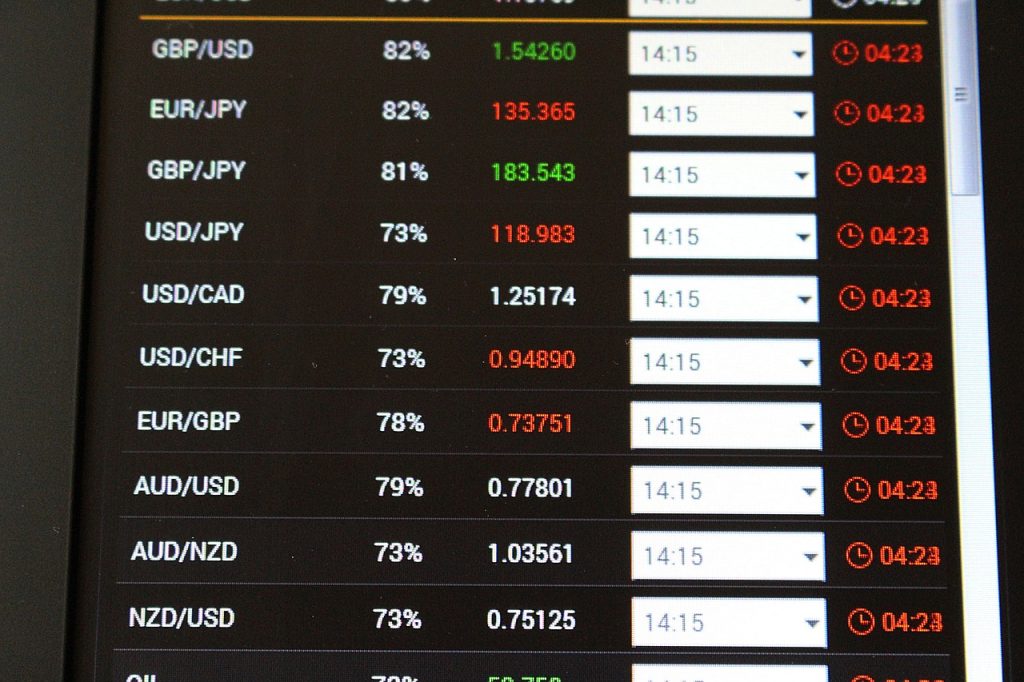

In the Forex market, the currency pairs belong to two categories: one category has all the currency pairs with the USD in their componence, and the other one with the rest of them.

The currency pairs with the USD in their componence are named majors. The rest crosses.

As such, one of the primary things to know when trading Forex is that majors and crosses form the Forex dashboard.

A Story of Valuations

The value of a currency fluctuates, depending on various factors. But when traders say that the USD rose or fell, that it’ll appreciate or depreciate, they must mention the counterpart too.

For example, the USD may be bullish against the JPY (USDJPY) and bearish against the EUR (EURUSD). As such, both the EURUSD and the USDJPY will rise, with the EURJPY cross increasing the most.

If you take all the currencies part of the currency pairs in the Forex dashboard, you’ll discover the world’s economy. After all, each currency represents an economy in the world.

The economic strength reflects in the value of its currency. Hence, when the economy expands, the central bank will raise the interest rate level on excess reserves, which makes the currency attractive to investors.

Because of that, quite many traders and companies specialized in analyzing economic data, use the information to buy and sell currencies. This is called fundamental analysis, and it doesn’t refer to one economy only. It depends on what the other counterpart (economy) is.

Research houses and investment funds use the same criteria to compare economies. Retail traders are familiar only with the most popular currency pairs in the Forex market (EURUSD, USDCAD, etc.), but these are the most difficult to trade.

Opportunities exist everywhere, and by using the same criteria for all economies, differences arise. Here are some of the data to consider when analyzing any economy:

- Inflation. The CPI or Consumer Price Index sits on the mandate of major central banks around the world. They target an inflation level around two percent, and it affects the value of different currencies. Most of the times the interest rate differential between two economies is the result of varying inflation levels.

- Unemployment rate. The lower the number, the better, and the adjacent data that comes with it matters too. For example, the labor force participation, as it tells much about the truth shown by the unemployment rate.

- PMI’s. The Purchasing Managers Index or PMI reflects how individual sectors in an economy perform. For example, the services, manufacturing or the construction sector. Hence, by looking at two service-based economies, the logical thing to do is to compare the PMI Services for the two and act on the differences, if any.

- GDP. The Gross Domestic Product shows the value of total goods and services produced by an economy. Various forms of GDP are released throughout the quarter and year, and differences between the values make traders buying or selling a specific currency or currency pair.

Apparently, the more data compared, the better, but the idea is to keep the same criteria.

Conclusion

Make sure to have the economic calendar always open. Ideally, ahead of the trading week, have a look at what the critical economic releases for the week ahead are.

In doing that, traders avoid unexpected volatility in the trading account, by simply ignoring the currencies affected by the most important news. Is it the Non-Farm Payrolls week and don’t know where the dollar will go? No worries: trade the EURJPY, EURGBP, AUDNZD or any other cross pair, that will avoid the unnecessary exposure to the USD volatility.

While not all traders are economists, economic news and data move the market. As such, knowing how it affects a trade helps in determining the profitability of it.